Featured

Table of Contents

Mortgage insurance pays off your home loan to the financial institution, while life insurance policy gives a death advantage to your picked recipient for numerous expenditures. All life insurance policy plans are developed to assist fill up monetary gaps that would certainly open up if the key carrier passed away suddenly.

This would certainly permit your family members to proceed living in the home you produced with each other. While all life insurance coverage plans pay a survivor benefit to the recipient cash that can be utilized to pay the home mortgage there are several various other variables to consider when it comes to selecting the right plan for your needs.

Depending on when you acquire a term life plan, it could provide security for the duration in your life when you have the most home expenses for your family members. Many individuals choose term life insurance to synchronize with the length of their home mortgage reward.

Consider talking with a financial rep who can aid you run the numbers and choose the ideal insurance coverage amount for your needs. While whole life and universal life insurance coverage can be made use of to assist pay home loan expenditures, numerous individuals select term life insurance policy rather due to the fact that it is often one of the most cost effective alternative.

Video Clip Transcript Hi! Bill Diehl right here at Western & Southern Financial Group and today we're mosting likely to speak about an idea called mortgage needs and just how a life insurance coverage policy may contribute with your home mortgage. You listened to that right: life insurance policy and mortgages. What's the deal? Why would any individual put life insurance policy and a home mortgage into the very same sentence? Well, life insurance policy can actually play a role in your mortgage technique.

What concerning you how are your loved ones safeguarded? Right here's where life insurance can be found in: if a breadwinner were to pass away a life insurance policy plan might potentially aid loved ones stay in the family home. insurance to protect your mortgage. Life insurance policy pays a prompt death benefit as quickly as evidence of death of the insured person is furnished to the insurance provider

Difference Between Life Insurance And Mortgage Insurance

And while these profits can be made use of for anything in the case of a mortgage security strategy, they're used to aid keep paying off the home mortgage hence allowing the making it through family members to continue to be in their home. That's the offer: life insurance and home mortgages can exist side-by-side and if you're interested in learning more concerning just how life insurance policy might play a role in your home loan method, talk to a monetary professional.

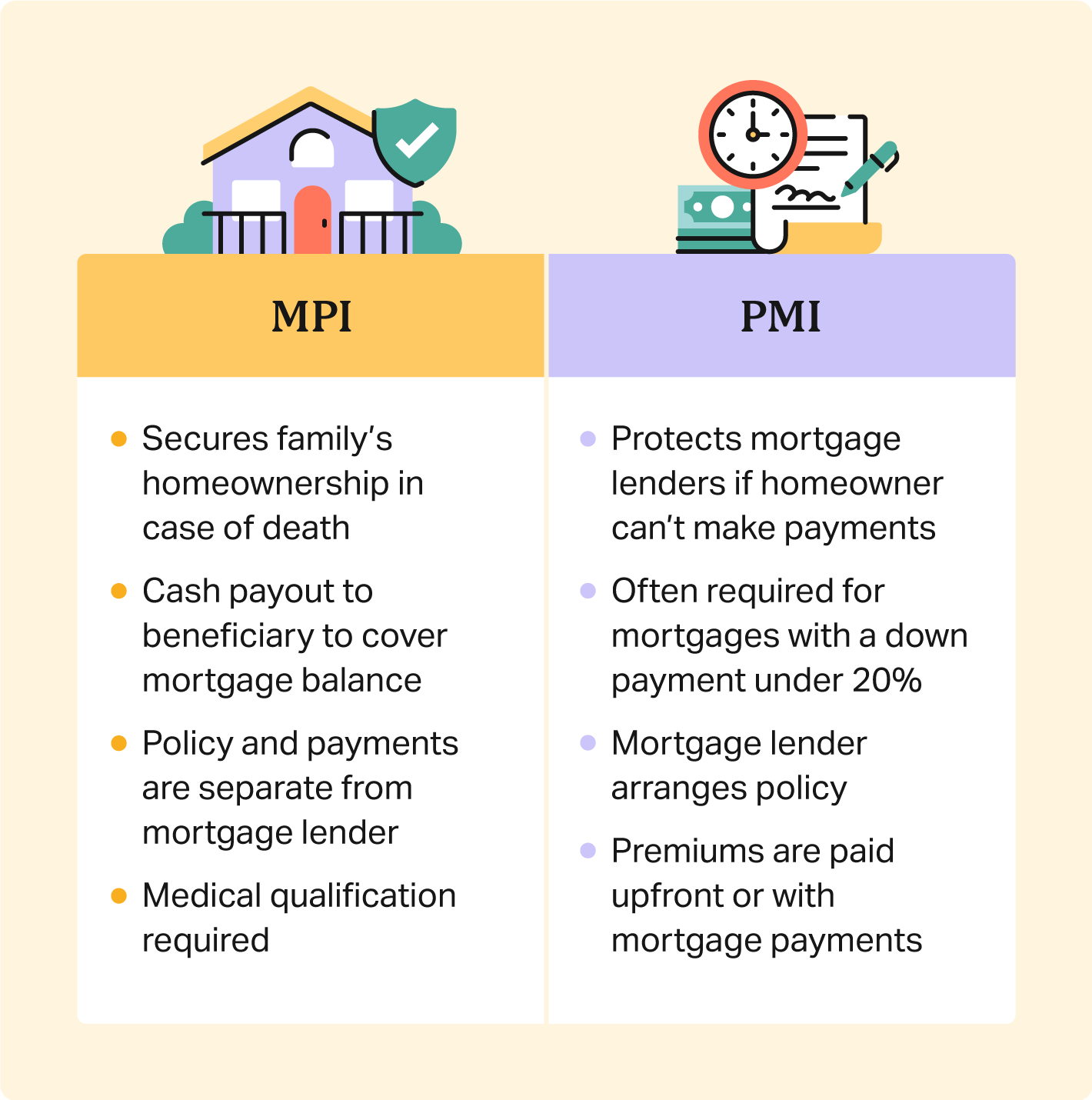

Home mortgage insurance policy is a type of insurance coverage that protects lenders in the occasion that a borrower defaults on their home mortgage settlements. The funding is designed to reduce the danger to the lender by supplying payment for any type of losses if the consumer is unable to settle.

Regular monthly mortgage payments are boosted to consist of the cost of PMI.: MIP is a type of insurance needed for some fundings guaranteed by the federal government, like FHA (Federal Real estate Management) fundings. mortgage payoff life insurance. It secures the lender against losses in case the customer defaults on the lending. MIP may be paid in advance at the time of finance closing as a single charge or as component of the customer's repeating month-to-month home mortgage settlements

It does not protect the consumer in situation of default yet permits consumers to obtain a home loan with a reduced down repayment. Also if you have home mortgage insurance coverage via your bank or home loan, you might still require life insurance policy. That's since bank home loan security just provides home loan benefit, and the beneficiary of that plan is usually the financial institution that would receive the funds.

Cover Mortgage Protection

It might help pay immediate expenses and offer mortgage defense. It can likewise help your loved ones settle financial obligations, cover education and learning expenses and even more. You may even be able to change the financial institution home loan insurance coverage with one purchased from a life insurance policy firm, which would certainly let you choose your recipient.

If a consumer were to die or lose the ability to hold down steady employment for example, due to an injury or medical issue MPI might cover the principal and rate of interest on the home finance. As a house owner with a mortgage, you need to prepare for the future. Allow's take a difficult appearance at what mortgage defense insurance coverage needs to supply so you can choose if it makes good sense to safeguard protection for on your own and your household.

Home mortgage protection insurance coverage is a totally different type of insurance policy.

MPI can aid ease those problems altogether. When you acquire MPI, your plan might cover the length of your home loan. So, if you have a 15-year fixed rate mortgage, your MPI plan might compete 15 years. MPI is occasionally also referred to as home mortgage life insurance coverage and even home loan death insurance due to the fact that it pays an advantage when the policyholder passes away, similar to typical life insurance coverage.

There may be exemptions that avoid beneficiaries from receiving a payment if the insurance policy holder were to die by self-destruction (in the first two years) instead than natural reasons or mishap. What if there are numerous debtors on a home finance? In numerous situations, you can get home loan security to cover 2 potentially a lot more co-borrowers or cosigners on a home loan.

As we noted, mortgage settlement security insurance can include unique bikers known as that cover chronic or essential health problem. They may additionally give insurance coverage for serious injuries that prevent policyholders from functioning at complete ability. In these cases, debtors are still alive, yet as a result of decreased revenues, are not able to make monthly mortgage payments completely.

Best Mortgage Insurance Company

Home loan protection insurance policy can cover just concerning any type of housing price you want. Repay your entire home mortgage in one go? You can do that. Place down simply the minimal monthly repayment on your home car loan? Absolutely. Make additional repayments on your home mortgage to construct equity and pay back your car loan faster? That's an option, too.

As soon as those funds hit your financial institution account, you can utilize them any kind of means you such as. Spend that money on your monthly housing costs, save it for a rainy day or cover various other expenditures like clinical expenses, car repayments and tuition. Where MPI can absolutely establish itself aside from term life insurance is with.

As an insurance holder, if you select to accelerate your home mortgage security insurance coverage payout, you can do so in just concerning any type of amount you such as. Purchase an MPI plan with living advantage motorcyclists for essential and chronic health problem.

Mortgage Rights Insurance

Offered exactly how helpful they can be for families taking care of challenge, though, it may be worth seeking an insurance policy specialist who specializes in these kinds of plans. In the vast majority of situations, MPI advantages are paid to the insurance policy holder's recipients. They can then invest that money any kind of means they such as.

That is, unless you take out a credit history life insurance policy. These insurance prepares offer the fatality advantage straight to your lending institution, who would certainly after that pay off your home loan.

It's free, easy and protected. Whether home loan life insurance policy is the right policy for you depends largely on your age and health. Young home owners with minimal medical concerns will certainly get far better quotes and higher protection alternatives with term life insurance policy. On the various other hand, if you have extreme health issue and won't get term life insurance policy, after that home mortgage life insurance coverage can be a good option, because it doesn't take your wellness into account when establishing prices and will use larger death advantages than lots of choices.

Some plans connect the death advantage to the impressive home loan principal. This will certainly behave likewise to a lowering fatality advantage, however if you repay your home loan faster or slower than anticipated, the plan will certainly mirror that. The fatality advantage will continue to be the same over the life of the plan.

Depending on the supplier, mortgage life insurance coverage. A mortgage defense policy that's packed right into your home loan is also a lot more restrictive, as you can't select to cancel your protection if it becomes unnecessary.

Home And Mortgage Insurance

You would certainly have to proceed paying for an unneeded advantage. Term and home loan life insurance coverage plans have a number of similarities, but particularly if you're healthy and balanced and a nonsmoker. Below are a few of the key distinctions between term life insurance coverage and home mortgage life insurance policy: Coverage amountAny amountMortgage principalCoverage length540 yearsMortgage lengthBeneficiary Your choice Home mortgage loan provider Survivor benefit paidUpon your deathPossibly only upon your unintentional deathUnderwritingHealth inquiries and medical examination Wellness concerns It's cost-free, basic and safe and secure.

If there are a lot more pressing expenditures at the time of your fatality or your family makes a decision not to maintain your home, they can make use of the complete term-life insurance coverage payout however they select. Home loan life insurance coverage quotes are more costly for healthy homeowners, since most policies do not need you to obtain a medical examination.

Latest Posts

Free Instant Online Life Insurance Quotes

Funeral Insurance Calculator

Final Expense Vs Whole Life