Featured

Table of Contents

"My advice is to acquire life insurance policy to cover the home mortgage in case one of the homeowners dies too soon (homebuyer protection insurance). Don't simply buy an amount of life insurance policy equivalent to the mortgage amount you have various other financial bases to cover," Doug Mitchell, proprietor of Ogletree Financial, a life insurance policy agency

It does not cover anything else such as last medical costs or funeral expenses like a standard life insurance policy. The factor it can not be utilized for anything else is due to the fact that the plan pays to your lender not your beneficiaries. While standard policies pay out to your household and can be utilized however they want, MPI pays to your lender and just covers the price of your home loan.

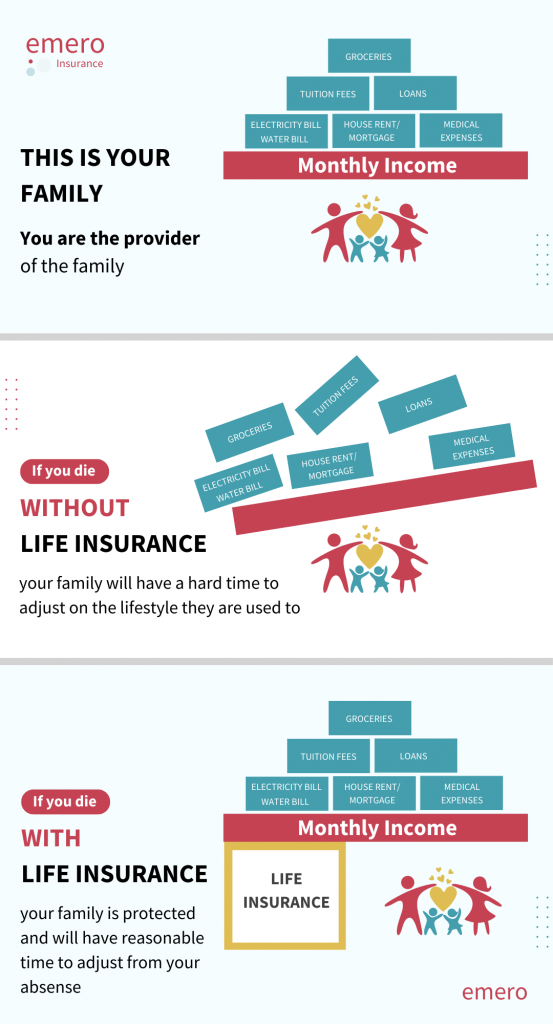

For several property owners, the home mortgage is the biggest monetary obligation they have. Some kind of mortgage security is important for home owners since it makes sure that your household can proceed staying in their home also if something unforeseen takes place to you. Getting ample insurance coverage protects against the threat of your family members facing repossession and provides monetary stability throughout a difficult time.

Yes, home loan security insurance policy normally covers the mortgage in the event of your death. It pays the continuing to be balance straight to the loan provider, making sure that your family members can remain in the home without bothering with making home loan repayments. This protection can be a useful safeguard, protecting against foreclosure and offering assurance during a tough time.

Selecting term policy gives alternatives for your family members to either use the death benefit to settle your house and use the remaining cash or also avoid paying the home mortgage and utilize the money as they like. If you are not eligible for term coverage, a home loan insurance policy is an excellent choice.

Insurance For Loan Against Property

For a lot of individuals, a term life insurance policy is the superior alternative. It is less expensive, more safety, and extra versatile than most mortgage defense insurance provider. Age Age 16 20 21 24 25 34 35 44 45 54 55 64 65+ Coverage Quantity Insurance Coverage Quantity $50,000 $100,000 $100,000 $200,000 $200,000 $300,000 $400,000 $500,000 $500,000 $1,000,000 $1,000,000 $2,000,000 $2,000,000 $5,000,000 $5,000,000+ Insurance Coverage Type Insurance Coverage Type Whole Life Term Life Final Expenditure Unsure Gender Gender Man Female Non-Binary.

So you've shut on your mortgage. Congratulations! You're now a property owner. This is among the largest financial investments you'll make in your life. And due to the time and money you have actually invested, it's likewise one of the most essential steps you'll absorb your life time. You'll desire to make certain that your dependents are covered in case you die prior to you pay off your home loan.

They might attract debtors who are in poor health and wellness or who have poor clinical histories. It's not like various other life insurance policy policies.

Mortgage Insurance Premium Meaning

If there's no home mortgage, there's no payback. While home mortgage life insurance coverage can secure youthe borrowerand their beneficiaries, mortgage insurance secures the loan provider if the debtor isn't able to satisfy their economic obligations.

Home loan life insurance is not mortgage insurancethe latter protects the lending institution in situation the customer defaults on their home mortgage financing for any kind of factor., be on the hunt for normal mailouts and phone telephone calls trying to offer you a home mortgage life insurance plan.

The other type of home loan life insurance policy is called degree term insurance. With this kind of policy, the payment doesn't reduce.

One more possibility is to get a policy that uses extra protection for a more affordable cost earlier in your home loan term. Some plans might return your costs if you never ever file an insurance claim after you pay off your home loan.

And also, you will certainly have likely misused the possibility to invest any cash you would have conserved, had you bought less expensive term life insurance. In fact, mortgage protection life insurance policy plans are normally foolhardy.

This kind of home mortgage life insurancewhich is sometimes referred to as lowering term insuranceis designed to pay off your home mortgage balance, while every month your recipient pays for component of your home loan principal. Subsequently, the plan's prospective payout reduces with every home loan repayment. On the various other hand, some more recent products have actually a feature called a degree survivor benefit where payments do not decline.

Best Home Loan Insurance

A far better treatment is to just purchase even more life insurance coverage. Those concerned regarding leaving behind costly home loans to their enjoyed ones ought to think about term life insurance policy, which is a commonly exceptional solution to home mortgage protection life insurance policy. New York Life, one of the best life insurance policy companies. loan cover policy, uses versatile term life insurance coverage plans.

This write-up considers home loan protection insurance policy, life insurance and home mortgage life insurance policy. Exactly how does mortgage life insurance coverage differ from a common life insurance policy? Both of these types of life insurance coverage can be made use of for home mortgage security purposes, but that does not inform the whole tale.

Life insurance coverage is usually a plan that supplies level cover if you pass away during the length of the policy. Simply put, the quantity of cover remains the exact same until the plan ends. If you're no longer around, it can provide security for a mortgage, and without a doubt any purpose, such as: Helping loved ones pay the house expenses Sustaining kids with greater education Paying the rent (not simply mortgage security).

For the function of the rest of this article, when discussing 'home mortgage life insurance' we are referring to 'decreasing home mortgage life insurance coverage'. Simply keep in mind that life insurance policy is not a savings or financial investment item and has no cash money worth unless a legitimate claim is made.

If you're healthy and have actually never used cigarette, you'll normally pay even more for home loan protection insurance coverage than you would for term life insurance policy. Unlike other sorts of insurance coverage, it's hard to get a quote for mortgage defense insurance coverage online. Rates for home loan security insurance coverage can differ widely; there is less transparency in this market and there are way too many variables to properly contrast prices.

Term life is a superb alternative for home mortgage defense. Policyholders can benefit from a number of benefits: The amount of protection isn't restricted to your home mortgage equilibrium.

Is Mortgage Protection Insurance Compulsory

You may want your life insurance coverage policy to shield greater than just your mortgage. You select the plan worth, so your insurance coverage can be basically than your home loan equilibrium. You could also have even more than one plan and "pile" them for personalized insurance coverage. By piling policies, or riders on your plan, you could lower the life insurance benefit gradually as your home mortgage equilibrium decreases so you're not spending for coverage you don't need.

If you're guaranteed and die while your term life policy is still active, your selected loved one(s) can use the funds to pay the home mortgage or for one more objective they pick. There are lots of advantages to making use of term life insurance to shield your home mortgage. Still, it may not be a perfect service for every person.

Yes and no. Yes, since life insurance policy plans tend to line up with the specifics of a mortgage. If you acquire a 250,000 residence with a 25-year home mortgage, it makes feeling to acquire life insurance policy that covers you for this much, for this lengthy. This way if you pass away tomorrow, or any time throughout the next 25 years, your home mortgage can be cleared.

Home Mortgage Group Insurance

Your family or recipients get their swelling sum and they can spend it as they like. It's important to comprehend, however, that the Mortgage Security payment amount lowers in line with your mortgage term and equilibrium, whereas degree term life insurance coverage will certainly pay the exact same swelling sum any time throughout the plan length.

On the other hand, you'll be active so It's not such as paying for Netflix. The sum you invest on life insurance every month does not pay back until you're no longer here.

After you're gone, your loved ones do not have to stress over missing out on repayments or being not able to manage living in their home. There are two main varieties of home mortgage protection insurance coverage, level term and lowering term. It's constantly best to obtain guidance to establish the policy that ideal talks to your requirements, spending plan and conditions.

Latest Posts

Free Instant Online Life Insurance Quotes

Funeral Insurance Calculator

Final Expense Vs Whole Life