Featured

Table of Contents

- – What is Level Term Life Insurance Policy? An O...

- – How Does What Is Direct Term Life Insurance Po...

- – What is Term Life Insurance With Level Premiu...

- – What is Term Life Insurance For Couples? A Gu...

- – What Are the Benefits of What Is Level Term ...

- – What is the Purpose of Level Premium Term Li...

- – What is Level Term Vs Decreasing Term Life I...

With this kind of level term insurance coverage plan, you pay the same month-to-month costs, and your recipient or beneficiaries would receive the same benefit in the occasion of your death, for the entire insurance coverage duration of the plan. So exactly how does life insurance policy work in regards to cost? The expense of level term life insurance policy will rely on your age and health in addition to the term length and insurance coverage amount you choose.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Woman$1,000,00030$43.3135 Man$500,00020$20.7235 Woman$750,00020$23.1340 Man$600,00015$22.8440 Female$800,00015$27.72 Price quote based on prices for qualified Place Simple candidates in superb health. No matter of what protection you select, what the policy's cash worth is, or what the swelling amount of the fatality benefit turns out to be, tranquility of mind is amongst the most useful advantages linked with purchasing a life insurance coverage policy.

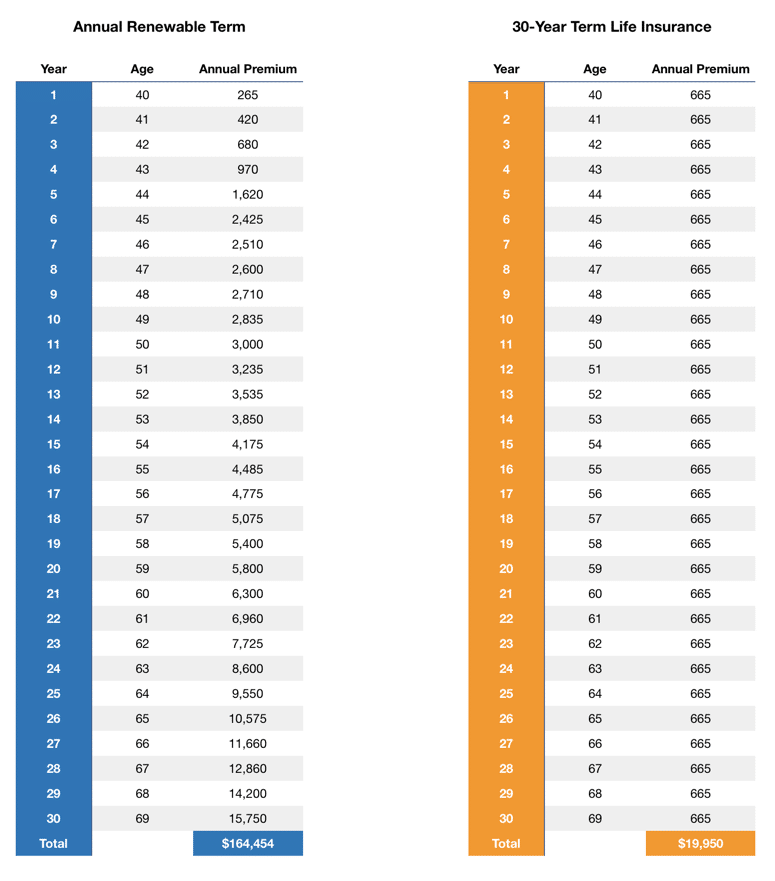

Why would certainly someone pick a plan with an each year sustainable costs? It may be a choice to consider for someone that requires insurance coverage only momentarily.

What is Level Term Life Insurance Policy? An Overview for New Buyers?

You can generally renew the policy each year which offers you time to consider your choices if you want coverage for longer. That's why it's helpful to acquire the appropriate amount and size of coverage when you first obtain life insurance policy, so you can have a reduced rate while you're young and healthy.

If you add essential unpaid labor to the family, such as childcare, ask on your own what it might set you back to cover that caretaking job if you were no much longer there. After that, make certain you have that coverage in position to make sure that your household obtains the life insurance coverage advantage that they need.

How Does What Is Direct Term Life Insurance Policy Work?

Does that imply you should always choose a 30-year term length? In general, a much shorter term plan has a reduced premium price than a longer plan, so it's clever to pick a term based on the predicted length of your monetary responsibilities.

These are very important factors to bear in mind if you were considering choosing a permanent life insurance such as an entire life insurance policy policy. Numerous life insurance policy plans provide you the alternative to add life insurance policy riders, assume added advantages, to your plan. Some life insurance plans come with riders integrated to the price of costs, or motorcyclists may be offered at an expense, or have costs when worked out.

What is Term Life Insurance With Level Premiums? What You Should Know?

With term life insurance policy, the communication that lots of people have with their life insurance policy company is a monthly bill for 10 to 30 years. You pay your monthly costs and hope your household will never ever have to utilize it. For the team at Haven Life, that looked like a missed opportunity.

We think browsing choices concerning life insurance policy, your individual funds and general health can be refreshingly basic (Level term vs decreasing term life insurance). Our content is developed for academic purposes only. Sanctuary Life does not recommend the business, items, services or methods discussed right here, yet we hope they can make your life a little less difficult if they are a fit for your situation

This product is not intended to offer, and should not be counted on for tax, lawful, or investment advice. People are encouraged to seed guidance from their own tax obligation or legal advice. Find Out More Place Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in particular states, including NC) released by Massachusetts Mutual Life Insurance Coverage Business (MassMutual), Springfield, MA 01111-0001 and supplied solely through Sanctuary Life Insurance Coverage Firm, LLC.

The ranking is as of Aril 1, 2020 and is subject to transform. Sanctuary Life And Also (And Also) is the advertising and marketing name for the Plus cyclist, which is included as component of the Sanctuary Term plan and offers access to extra services and advantages at no expense or at a discount.

What is Term Life Insurance For Couples? A Guide for Families?

If you depend on somebody monetarily, you may question if they have a life insurance coverage plan. Find out exactly how to find out.newsletter-msg-success,.

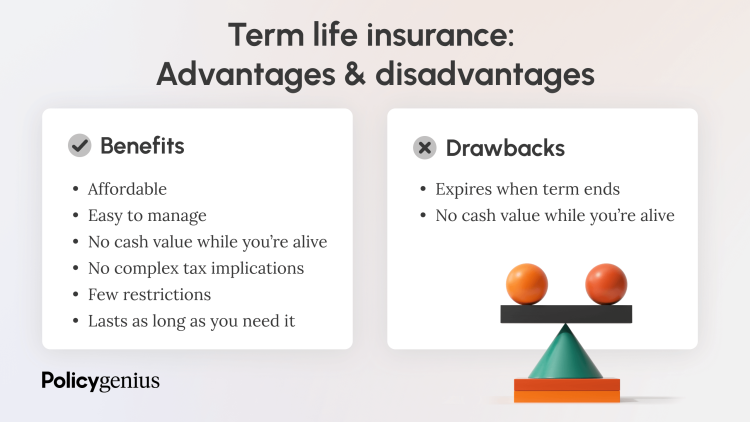

When you're more youthful, term life insurance policy can be a straightforward way to protect your enjoyed ones. As life changes your financial concerns can also, so you may desire to have entire life insurance coverage for its life time protection and extra benefits that you can utilize while you're living.

What Are the Benefits of What Is Level Term Life Insurance?

Approval is assured despite your health and wellness. The premiums won't increase when they're established, however they will certainly increase with age, so it's an excellent concept to lock them in early. Discover a lot more concerning exactly how a term conversion works.

The word "degree" in the phrase "level term insurance" implies that this kind of insurance has a fixed costs and face amount (survivor benefit) throughout the life of the plan. Basically, when people speak regarding term life insurance policy, they normally describe level term life insurance policy. For most of people, it is the easiest and most inexpensive choice of all life insurance policy types.

What is the Purpose of Level Premium Term Life Insurance?

Words "term" here describes a given number of years throughout which the level term life insurance policy stays energetic. Degree term life insurance policy is one of one of the most prominent life insurance policy policies that life insurance policy suppliers provide to their clients because of its simpleness and affordability. It is likewise very easy to contrast level term life insurance quotes and get the very best premiums.

The mechanism is as adheres to: Firstly, pick a policy, death advantage amount and policy period (or term length). Second of all, select to pay on either a regular monthly or yearly basis. If your early death takes place within the life of the policy, your life insurance firm will pay a round figure of survivor benefit to your predetermined recipients.

What is Level Term Vs Decreasing Term Life Insurance and Why Does It Matter?

Your degree term life insurance policy ends when you come to the end of your policy's term. Now, you have the complying with choices: Option A: Keep without insurance. This alternative fits you when you can guarantee on your own and when you have no debts or dependents. Option B: Get a new level term life insurance plan.

1 Life Insurance Coverage Statistics, Information And Market Trends 2024. 2 Price of insurance policy rates are established making use of approaches that vary by business. These rates can differ and will normally increase with age. Rates for active employees might be various than those available to terminated or retired staff members. It is essential to take a look at all variables when examining the overall competition of rates and the worth of life insurance policy protection.

Table of Contents

- – What is Level Term Life Insurance Policy? An O...

- – How Does What Is Direct Term Life Insurance Po...

- – What is Term Life Insurance With Level Premiu...

- – What is Term Life Insurance For Couples? A Gu...

- – What Are the Benefits of What Is Level Term ...

- – What is the Purpose of Level Premium Term Li...

- – What is Level Term Vs Decreasing Term Life I...

Latest Posts

Understanding Level Term Life Insurance Meaning

What is Life Insurance? Understanding Its Purpose?

How Does Term Life Insurance For Seniors Keep You Protected?

More

Latest Posts

Understanding Level Term Life Insurance Meaning

What is Life Insurance? Understanding Its Purpose?

How Does Term Life Insurance For Seniors Keep You Protected?