Featured

Table of Contents

That normally makes them a much more budget-friendly choice for life insurance protection. Many individuals get life insurance coverage to help financially safeguard their loved ones in case of their unanticipated death.

Or you may have the option to transform your existing term protection into an irreversible plan that lasts the rest of your life. Various life insurance plans have prospective benefits and downsides, so it's essential to comprehend each before you determine to buy a plan.

As long as you pay the costs, your recipients will obtain the death advantage if you pass away while covered. That stated, it is very important to note that many policies are contestable for 2 years which implies coverage can be rescinded on fatality, must a misrepresentation be found in the app. Plans that are not contestable frequently have actually a graded survivor benefit.

What is Simplified Term Life Insurance? Comprehensive Guide

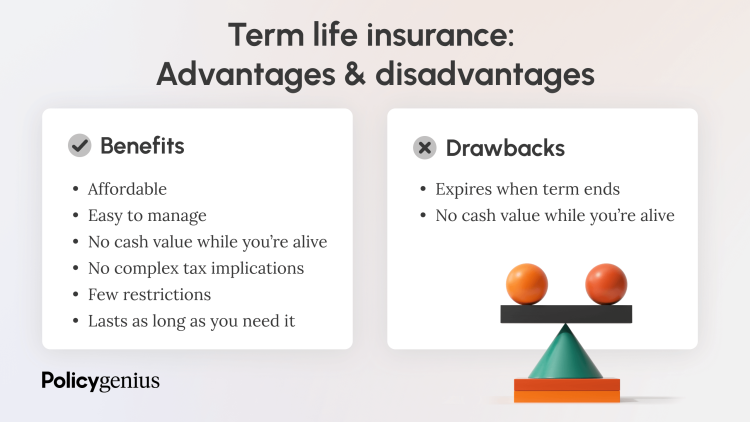

Costs are normally reduced than whole life plans. With a degree term policy, you can pick your protection amount and the plan size. You're not secured into an agreement for the rest of your life. Throughout your policy, you never ever have to stress over the costs or survivor benefit quantities altering.

And you can not pay out your plan during its term, so you won't receive any type of financial advantage from your past coverage. As with other kinds of life insurance policy, the price of a level term policy depends on your age, protection needs, employment, way of living and health. Normally, you'll find much more cost effective insurance coverage if you're younger, healthier and less dangerous to insure.

Considering that level term premiums remain the very same for the duration of coverage, you'll understand exactly just how much you'll pay each time. Degree term protection likewise has some flexibility, permitting you to personalize your plan with added attributes.

Why Consider Term Life Insurance?

You may have to meet specific problems and certifications for your insurance provider to enact this cyclist. Furthermore, there might be a waiting duration of as much as six months before working. There additionally can be an age or time limitation on the insurance coverage. You can add a child cyclist to your life insurance policy policy so it likewise covers your youngsters.

The fatality advantage is generally smaller sized, and protection usually lasts up until your child transforms 18 or 25. This motorcyclist might be a much more economical means to help guarantee your children are covered as bikers can often cover multiple dependents at when. Once your child ages out of this insurance coverage, it may be possible to transform the motorcyclist into a brand-new plan.

The most usual type of irreversible life insurance is entire life insurance coverage, yet it has some crucial differences compared to degree term coverage. Here's a standard summary of what to think about when comparing term vs.

What is the Advantage of Term Life Insurance With Level Premiums?

Whole life entire lasts insurance coverage life, while term coverage lasts protection a specific periodDetails The premiums for term life insurance policy are normally reduced than whole life coverage.

One of the primary features of degree term protection is that your premiums and your fatality advantage don't transform. You may have coverage that starts with a fatality advantage of $10,000, which might cover a home loan, and after that each year, the fatality advantage will certainly reduce by a set quantity or percent.

Due to this, it's typically a much more affordable type of degree term coverage. You may have life insurance policy with your company, but it may not suffice life insurance policy for your requirements. The very first step when purchasing a policy is identifying just how much life insurance you require. Think about elements such as: Age Family members dimension and ages Work standing Revenue Financial obligation Way of living Expected last expenses A life insurance policy calculator can assist identify just how much you require to start.

What is 20-year Level Term Life Insurance? Quick Overview

After selecting a plan, finish the application. For the underwriting process, you may have to offer basic personal, health and wellness, way of living and work information. Your insurance company will certainly determine if you are insurable and the danger you may present to them, which is reflected in your premium expenses. If you're approved, authorize the paperwork and pay your very first costs.

Take into consideration scheduling time each year to examine your plan. You might want to upgrade your recipient info if you've had any kind of significant life modifications, such as a marriage, birth or divorce. Life insurance policy can occasionally feel difficult. But you don't have to go it alone. As you discover your alternatives, take into consideration reviewing your needs, desires and interests in a financial professional.

No, level term life insurance coverage doesn't have cash money value. Some life insurance policy policies have an investment function that enables you to build cash value in time. A section of your costs settlements is reserved and can earn rate of interest in time, which grows tax-deferred throughout the life of your insurance coverage.

These plans are usually considerably a lot more costly than term insurance coverage. If you reach completion of your plan and are still to life, the coverage ends. However, you have some choices if you still desire some life insurance policy protection. You can: If you're 65 and your protection has gone out, for instance, you may want to acquire a brand-new 10-year level term life insurance policy.

The Essentials: What is 10-year Level Term Life Insurance?

You might be able to transform your term insurance coverage into a whole life policy that will certainly last for the rest of your life. Several kinds of level term policies are exchangeable. That indicates, at the end of your coverage, you can convert some or all of your policy to whole life insurance coverage.

A degree costs term life insurance strategy lets you adhere to your budget plan while you help shield your family members. Unlike some stepped rate strategies that enhances every year with your age, this sort of term plan uses rates that remain the very same for the period you pick, even as you grow older or your wellness adjustments.

Discover more regarding the Life Insurance policy options offered to you as an AICPA participant (term life insurance for seniors). ___ Aon Insurance Policy Providers is the brand for the brokerage and program administration operations of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Coverage Company, Inc. (CA 0795465); in OK, AIS Affinity Insurance Policy Solutions Inc.; in CA, Aon Affinity Insurance Coverage Solutions, Inc .

Latest Posts

Free Instant Online Life Insurance Quotes

Funeral Insurance Calculator

Final Expense Vs Whole Life